Architecture

Users

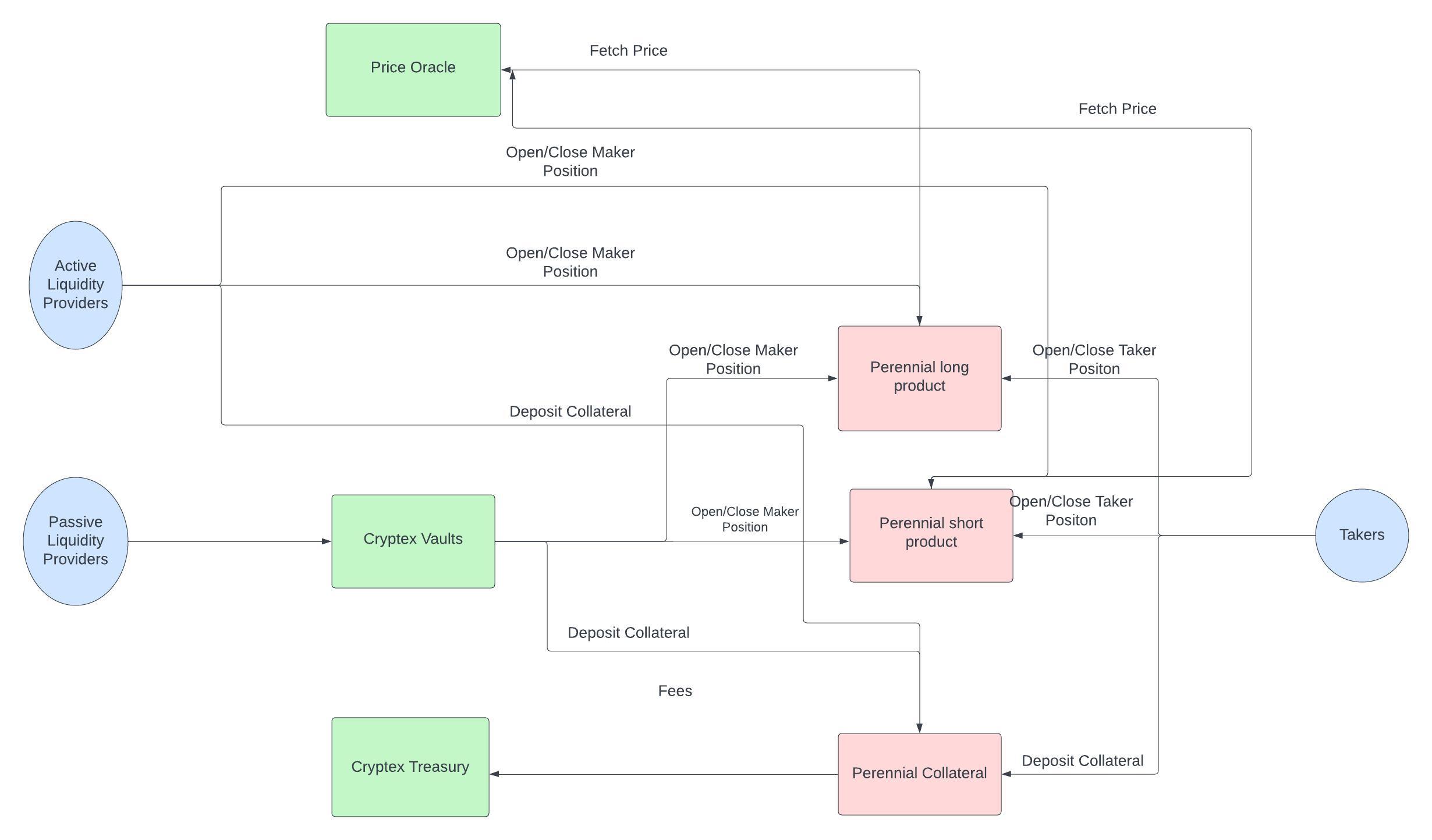

There are primarily three types of users that use the Cryptex product.

- Takers: They deposit collateral in exchange for exposure to the Oracle price feeds.

- Passive liquidity providers: They deposit liquidity in vaults which is then managed by the vault.

- Active liquidity providers: They provided liquidity on a selected side of the market i.e long or short.

Vaults

Vaults are smart contracts that allow users to provide liquidity in a passive way. The vault has logic to actively manage the maker positions opened by it. Vaults hedge maker positions by providing liquidity both sides of market. The fees, profits and losses are divided amongst the users in proportion to their shares.

Price Oracle

The long and short product create positions based on a underlying price feed that comes from Oracles. The product currently uses chainlink oracles.

Treasury

The fees generated through trading activity is stored in the treasury. The treasury is owned and controlled by the cryptex DAO.

Perennial's Collateral Contract

The collateral contract stores and keeps track record of the collateral deposited by the user.

Perennial's Products

The product contracts are core contracts that have logic for the perpetual futures. The long and short are deployed as separate instances of the product contract.