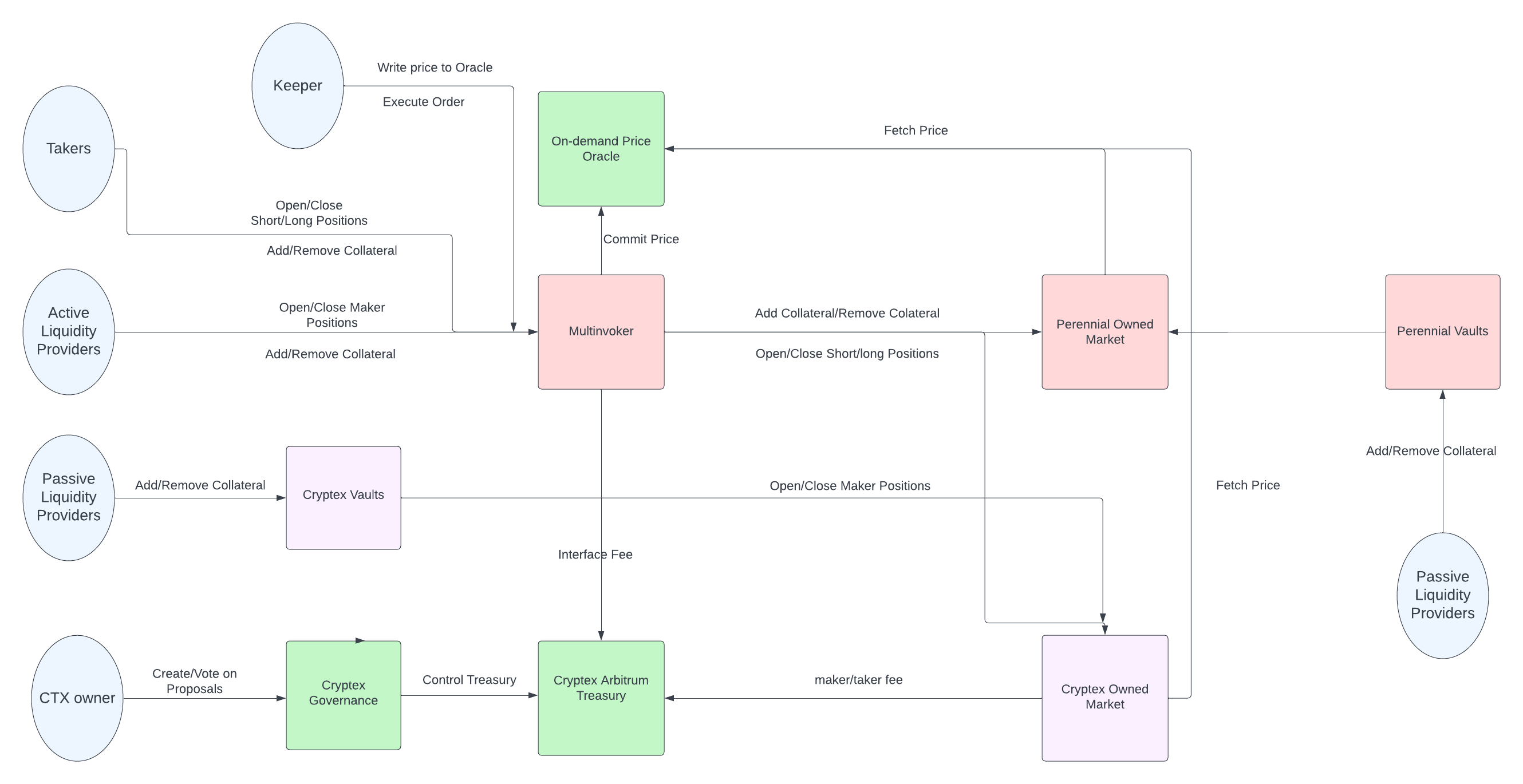

Architecture for version π

Users

There are primarily five types of users of Cryptex Finance π.

- Takers: They deposit collateral in exchange for exposure to the Oracle price feeds.

- Passive liquidity providers: They deposit liquidity in vaults which is then managed by the vault.

- Active liquidity providers: They provided liquidity to selected markets and manage their maker positions by themselves.

- Keepers: These users ensure that price updates are regularly written on-chain in exchange for a fee. They also execute orders like limit orders, stop loss orders whenever the market conditions are met.

- CTX users: The CTX users can vote on proposals and they can control the treasury through proposals.

Vaults

Vaults are smart contracts that allow users to provide liquidity in a passive way. The vault has logic to actively manage the maker positions opened by it. The vaults deploy liquidity to multiple markets based on a predefined strategy. Vaults hedge maker positions by providing liquidity both sides of market. The fees, profits and losses are divided amongst the users in proportion to their shares.

Price Oracle

The protocol uses on-demand oracles as price feeds for the markets. The price feeds need to be constantly updated by a keeper in exchange for a fee. The low latency oracles are built by Pyth network.

Treasury

The fees generated through trading activity is stored in the treasury. The treasury is owned and controlled by the cryptex DAO.

Perennial's market

The market contracts are core contracts that have logic for the perpetual futures. The long, short and maker positions are handled by this contract. It also has the logic for settlements and liquidations.

Multi Invoker

The multi-invoker is a smart contract that acts as a gateway for perennials smart contracts. It allows users/interfaces to make multiple actions on perennial through a single transaction.