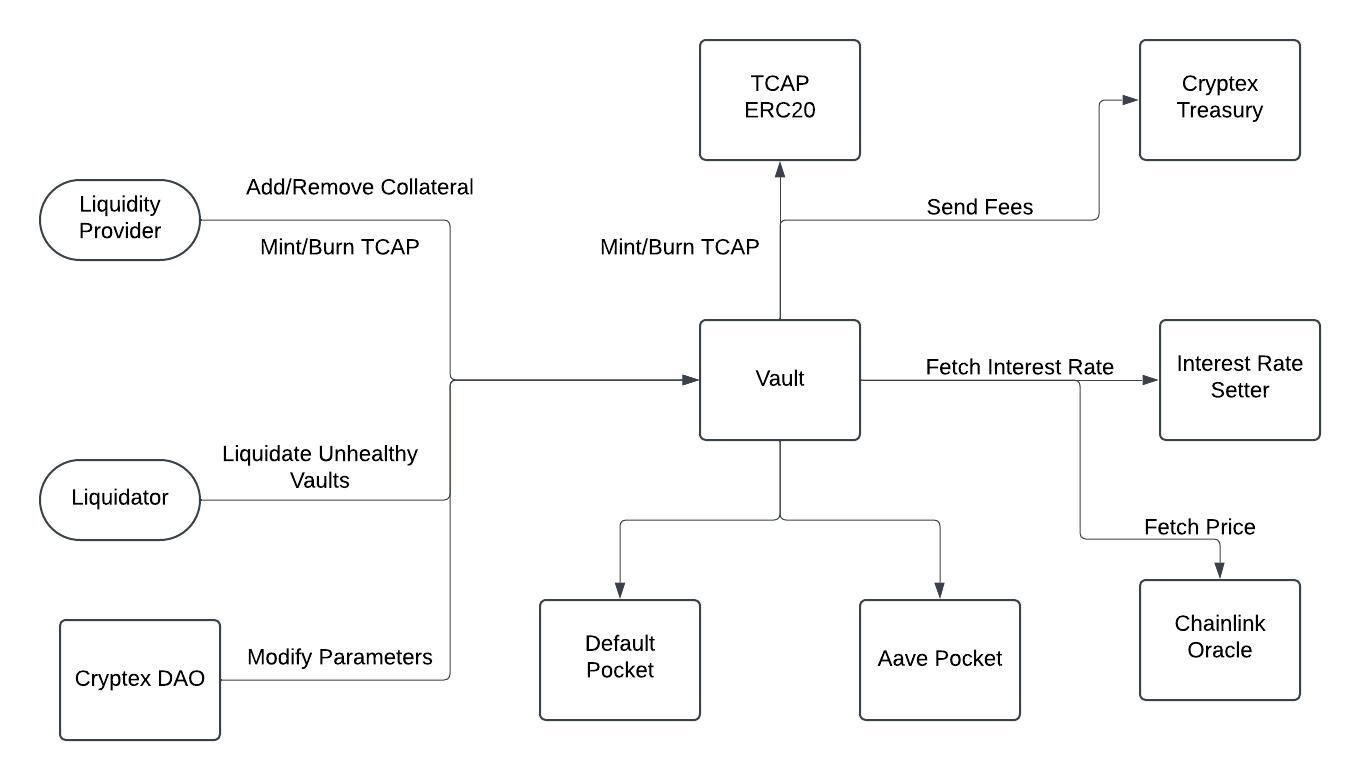

TCAP Architecture

System Components and Interactions

- Liquidity Provider

-

Role: Supplies collateral to the Vault.

-

Actions:

- Adds or removes collateral.

- Mints or burns TCAP tokens based on the collateral deposited.

- Vault (Heart of the System)

-

Role: Manages collateral and ensures the smooth functioning of TCAP issuance and redemption.

-

Structure: Divided into two pockets:

-

Default Pocket: Holds collateral without generating any interest.

-

Aave Pocket: Deposits collateral into Aave to earn interest.

-

-

Responsibilities:

-

Stores collateral provided by Liquidity Providers.

-

Facilitates the minting and burning of TCAP tokens.

-

Integrates with external components (e.g., Chainlink Oracle, Interest Rate Setter) for stability and price tracking.

-

- TCAP ERC20

-

Role: Represents the synthetic token pegged to the total cryptocurrency market capitalization.

-

Actions:

-

Minted or burned through interactions with the Vault.

-

Fee revenue from minting and burning operations is sent to the Cryptex Treasury.

-

- Cryptex Treasury

-

Role: Receives fees from the minting and burning of TCAP tokens.

-

Purpose: Maintains the sustainability and growth of the protocol by managing collected fees.

- Interest Rate Setter

-

Role: Ensures peg stability for TCAP by dynamically adjusting interest rates.

-

Actions:

-

Sets interest rates for collateral in the Vault.

-

Collaborates with the Vault to stabilize TCAP's value.

-

- Chainlink Oracle

-

Role: Provides the market price of the total cryptocurrency market capitalization.

-

Actions: Feeds price data to the Vault for accurate minting and burning of TCAP.

- Cryptex DAO

-

Role: Decentralized governance body managing the protocol.

-

Actions:

-

Modifies protocol parameters as needed.

-

Ensures the protocol adapts to market changes.

-

- Liquidator

-

Role: Ensures the health of the system by liquidating unhealthy Vaults.

-

Actions: Monitors Vaults and liquidates positions with insufficient collateral.

Workflow Overview

Minting and Burning TCAP

-

A Liquidity Provider deposits collateral into the Vault.

-

The Vault calculates the amount of TCAP to mint based on the collateral value (tracked using Chainlink Oracle data).

-

Minted TCAP is issued to the Liquidity Provider.

-

For burning, TCAP is returned to the Vault, and the corresponding collateral is released.

Interest and Collateral Management

-

The Vault manages collateral through two pockets:

-

Default Pocket: Simple storage of collateral.

-

Aave Pocket: Generates interest by lending collateral on Aave.

-

-

The Interest Rate Setter adjusts rates to maintain the TCAP peg and incentivize desired collateral usage.

Fee Management

-

Minting and burning operations incur fees.

-

Fees are transferred to the Cryptex Treasury to support protocol operations and development.

Stability Mechanism

-

The Interest Rate Setter adjusts rates to counteract price deviations of TCAP.

-

The Chainlink Oracle ensures real-time price tracking of the total cryptocurrency market cap.

Liquidation Process

-

Vaults with insufficient collateral ratios are flagged as unhealthy.

-

Liquidators step in to liquidate these Vaults, maintaining system integrity.